The US Stock Composite is a widely-followed indicator that provides a snapshot of the overall performance of the American stock market. By understanding what it represents and how it's calculated, investors can gain valuable insights into market trends and make informed decisions. In this article, we'll delve into the details of the US Stock Composite, its significance, and how it can be used to gauge market conditions.

What is the US Stock Composite?

The US Stock Composite, often abbreviated as US Composite, is a stock market index that tracks the performance of a broad range of companies listed on major U.S. exchanges. It includes stocks from various sectors, such as technology, finance, healthcare, and consumer goods, offering a comprehensive view of the market's overall health.

Composition and Calculation

The US Composite is composed of the largest and most actively traded companies in the United States. The index is calculated using a market capitalization-weighted methodology, which means that the value of each stock's weight in the index is proportional to its market capitalization.

This approach ensures that the index reflects the true value of the companies it includes. As the market capitalization of a company changes, its weight in the index will also adjust, providing a dynamic and accurate representation of the market.

Significance of the US Stock Composite

The US Stock Composite is a crucial tool for investors, analysts, and market watchers for several reasons:

Case Study: The Impact of the US Stock Composite on the Market

One notable example of the US Stock Composite's impact on the market is the 2008 financial crisis. As the crisis unfolded, the US Composite plummeted, reflecting the widespread panic and uncertainty in the market. This decline prompted investors to reassess their portfolios and led to a significant shift in market sentiment.

How to Use the US Stock Composite

To effectively use the US Stock Composite, investors should consider the following tips:

Conclusion

The US Stock Composite is a powerful tool that provides a comprehensive view of the American stock market. By understanding its composition, calculation, and significance, investors can make informed decisions and stay ahead of market trends. Whether you're a seasoned investor or just starting out, the US Stock Composite is an essential resource for anyone looking to navigate the complexities of the stock market.

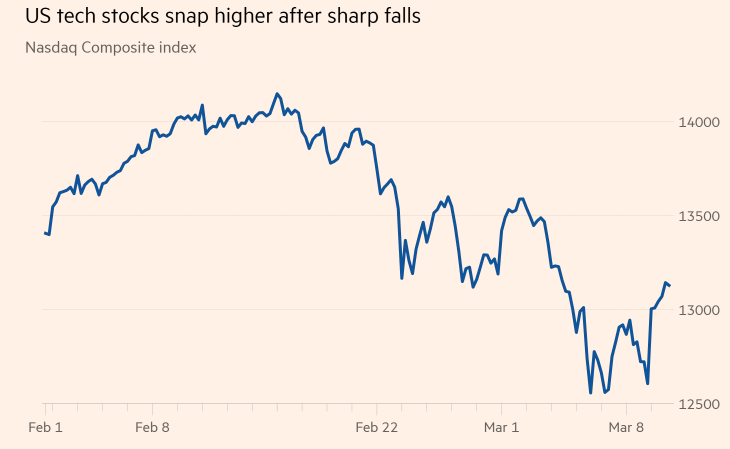

nasdaq composite